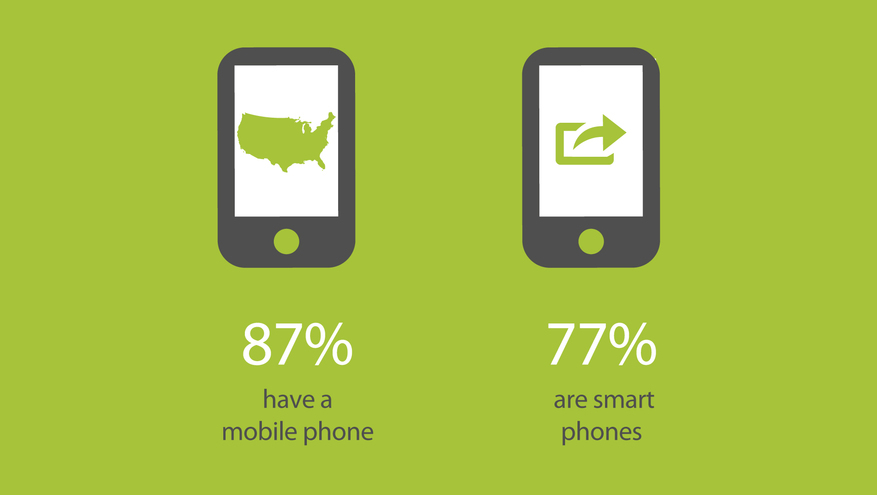

We all live busy lives, and when we discover something that makes life a little easier, we jump on it! The mobile smartphone is one of those tools that has quickly become essential in our lives. According to a 2015 survey conducted by the U.S. Federal Reserve:

- 87% of the U.S. adult population has a mobile phone

- 77% of mobile phones are smartphones (Internet-enabled)

Consequently, the adoption of mobile banking continues to increase, with consumers using their mobile phones to make bank deposits, take out loans, check bank balances, make payments, budget, and pay for goods and services online and at retailers with Apple Pay® or Android Pay®. And, it’s no surprise that the majority of those surveyed say “convenience” is the reason for embracing mobile banking. When you’re sitting in the car waiting to pick up your daughter from soccer practice, or you’re waiting for your lunch to be served at a restaurant, you can pay a bill, transfer funds to an account or even deposit a check. Mobile banking helps you take advantage of your time and more securely stay in control of your finances at the touch of a fingertip.

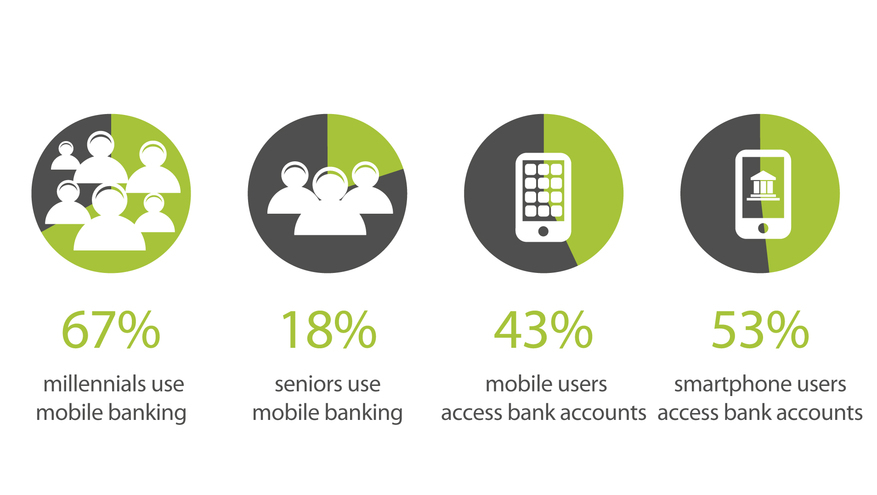

Use And Frequency Of Mobile Banking:

- 67% of millennials use mobile banking

- 18% of adults 60 and over use mobile banking

- 43% percent of all mobile phone owners with a bank account had used mobile banking in the past 12 months

- 53% of smartphone owners with a bank account had used mobile banking in the past 12 months

And, mobile banking can help you with your personal or business banking. Business owners can manage important operational functions in the mobile space such as mobile check deposit, approving payroll, wiring funds or checking on the status of a loan.

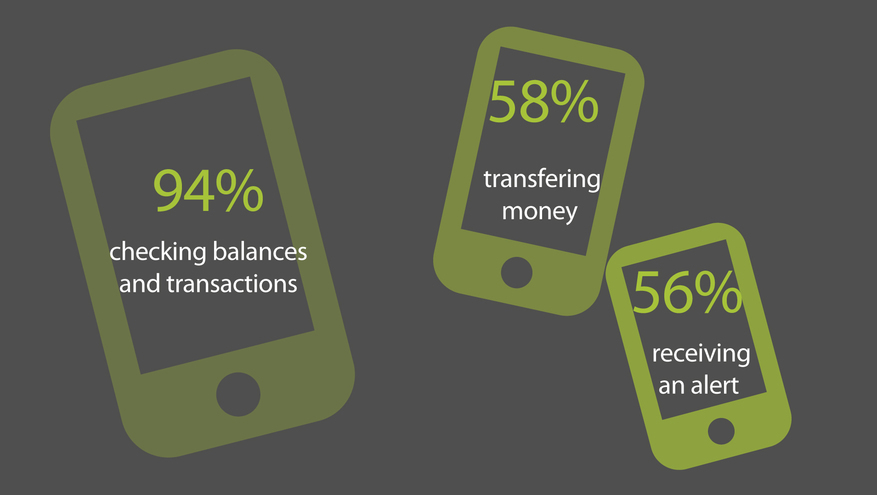

Three Most Common Mobile Banking Activities:*

- 94% said checking account balances or recent transactions

- 58% reported transferring money between an individual’s own accounts

- 56% said receiving an alert (e.g., a text message, push notification, or e-mail) from their bank

Mobile banking also helps smartphone users to make better financial decisions. Upon receiving a low balance text alert from your bank, you can transfer or deposit money into the low-balance account or even choose to reduce your spending.

With the Bank of Utah mobile app, your nearest bank is virtually in the palm of your hand. Access your accounts anytime, anywhere:

- Manage all accounts 24/7

- Transfer funds

- Monitor account alerts

- Access electronic versions of paper statements

- Schedule single or recurring bill payments

- Deposit checks, and more!

Mobile Banking Security Tips

Because you may be doing your mobile banking in public places you will want to make sure you follow these tips to assure your transactions are more secure.

- Do NOT use a public Wi-Fi connection while conducting online banking. Use your cell phone data or your own secure Wi-Fi connection.

- If you receive unusual emails or texts in regard to your banking, don’t click on the links. There are fraudsters out there who are just waiting to compromise your phone or gather account data via a public Wi-Fi. Check with your bank to authenticate the message before acting.

- Don’t conduct your mobile banking while driving or walking, or you’ll endanger yourself and others!

- Be aware of your surroundings. Just like when entering your PIN at an ATM, avoid “shoulder surfers” while conducting mobile banking. Find a private space.

Bank of Utah's innovative mobile banking platform allows you to control and access your money when and how you want to. NOT USING MOBILE BANKING YET? Start by downloading our free mobile banking app, for your iPhone, iPad or Android.** Follow the simple instructions, and if you get stumped, call Bank of Utah’s customer service line at 1-801-409-5000, and we will walk you through the process. Good luck and enjoy the extra time and control of your finances!

Craig Roper

Senior Vice President/Chief Deposit Officer

Bank of Utah