A few weeks ago, school supply displays started their annual takeover of the front aisles of local stores. Boxes of paper and pencils replaced beach towels and bags of charcoal, signaling the end of summer and ushering in the new school year. Children and parents have been busily checking off items from their school supply lists — a pack of markers here, a notebook there. It’s among the shelves that comments like these can be heard:

“No, not the 120-count pack of crayons, you only need the 24-count.”

“I know that Trapper Keeper is neat. I had one once, but you don’t need it. It’s not on your list.”

“Yes, I love that Baby Yoda backpack, but your backpack from last year is still in good shape.”

As a banker and a parent, I love hearing these conversations, and I have some advice for moms and dads: Don’t stop there! You have just created the perfect opportunity to talk about needs versus wants — a foundational lesson to help your children understand spending decisions. Don’t let it pass you by!

Everyday experiences, like back-to-school shopping, can be used to communicate key financial lessons and demonstrate good financial habits. By starting young and building the lessons over time — from needs versus wants, to budgeting, to spending and saving — you will be setting your kids up for future success, when there’s more at stake than just crayons and backpacks, like credit scores and mortgages.

Here are some important lessons you can start teaching your kids to put them on the right financial path.

4 Lessons to Teach Kids About Money

1. Start Simple: How Money is Used and Earned

You can teach children from a very young age about the role money plays in life. The trick is to get hands-on. Work money into imaginary play. Set up a “grocery shop” in the living room or a “restaurant” at the dining room table. Assign a cost to items or meals and then make your own money, or use real cash, to “check out” or “pay the bill.” Toy cash registers are a great addition to this game — some of which now even come with a debit card “reader,” another real-life lesson in the different types of payments we use today.

As your children get older, you can bring them to a real grocery store or restaurant and talk about how much each item or meal costs. You can even let them pay the cashier with cash, so they get used to handing the money over, or have them insert your debit card into the machine for a different payment experience!

As your children start to understand how money is used to pay for items, begin to teach them how money is earned. Discuss how you get paid for doing the job you do, and give them opportunities to have and earn their own money. You can do this through allowance or additional task or activities (chores, reading books, good grades, etc.). Once your son or daughter successfully completes these tasks, make sure to pay them. We all want to get paid for what we have earned, right!

For older children and teenagers, get them involved in additional money-earning opportunities, such as getting a part-time job, babysitting or offering neighborhood lawn care services.

2. Move on to Spending and Saving

Helping your child know what to do with the money they earn is also important. They see you spending money to purchase things, but they should also know money is for saving, too.

You can start teaching children the concept of saving money very early. All you need is two piggy banks or jars — one for spending and one for saving (you can even add a third for charitable contributions if you’d like). This helps then to visualize how much money they have and where it needs to go. Hopefully, they will watch that savings jar grow! Help them set a financial goal, so they have something specific to save for, such as buying a new bike or even buying their first car!

Those piggy banks and jars can be upgraded to a savings account (Bank of Utah has a savings option just for kids under 18 that can be opened for just $10). Be sure to take the time to explain how they can grow their money by earning interest.

And when it comes to the spending jar, you can use it to start discussions about needs and wants. Tell them that needs — things you must have — should always receive a greater priority than wants — things you can enjoy later. Circling back to the school supply list example I mentioned earlier, you can explain that while yes, the 120-count pack of crayons is much more wonderful than the 24-count, it’s also more expensive and isn’t on the list. It’s a want, not a need. The same with the Baby Yoda backpack — while it’s cute, it isn’t needed because last year’s backpack is still in good condition.

If your child is a student, and is at least 16, consider upgrading the spending jar to a student checking account. They can use this account to manage their money and use the digital tools associated with it, such as online banking, to build strong financial habits.

3. Teach Budgeting

No matter how small their income, you should get your children into the habit of budgeting and making a plan for their money.

Involve your children in your own household budget. Sit down together and go over the different categories you use to divide up your monthly income. Next, walk your child through how you decide where to spend your money. Have them look at their own spending/saving jars or bank accounts and come up with budget categories. Young children can start with needs and wants, like we mentioned above. Older kids can be more specific — budgeting for a cell phone payment, car insurance or entertainment.

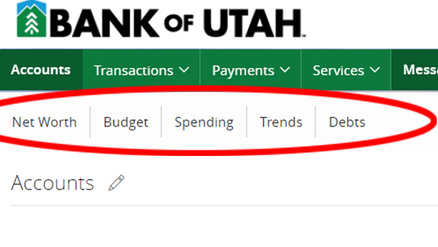

If your child has a bank account, be sure to look for the budgeting tool that can be found within online banking. They are highly visual and can help young budgeters (and people of all ages, really) better manage their money.

4. Don’t Forget the Credit Talk

As children get older, start helping them build good credit. Begin by explaining how credit works, that credit cards, in particular, are used to “borrow” money to make purchases. Since the money is “borrowed” it has to be paid back on time. Be sure to tell them that credit cards have to be used responsibly or they will end up wasting money on high interest rates and late fees, and that this can ruin their credit score.

Show them your credit report and go over what a good credit score entails. Explain the benefits of a good credit score — better interest rates on loans, getting approved for credit, etc.

When your child is 18, and is ready, you can help them to get their first credit card account. You can apply online or at any branch. If you are comfortable in being a co-applicant, you can help facilitate the approval process. Having and learning to manage a credit card responsibly is a good way to help your child build their own credit.

A Final Thought

As a parent myself, I can attest to how important these lessons are, but there has also been research on it as well. A recent study showed that kids are eager for parents to share their financial wisdom. T. Rowe Price’s 11th Annual Parents, Kids & Money Survey found half of the children surveyed wished their parents taught them more about money. If you need additional advice on how to talk to your kids about finances, feel free to come into any branch. We would be happy to help you!

And some final advice: Be open with your children about your own experiences with money. Help them learn from your mistakes, as well as your successes. Encourage them to ask questions and work with them through the process. As your children get older, they just might thank you for your efforts. Ours did!

Ruth Bigger is the branch manager for Bank of Utah’s Providence Branch. She has worked for the Bank for nine years. Her favorite part of the job is getting to know customers and helping them with their unique financial needs.

Ruth Bigger is the branch manager for Bank of Utah’s Providence Branch. She has worked for the Bank for nine years. Her favorite part of the job is getting to know customers and helping them with their unique financial needs.