July summer nights in Utah erupt with vibrant fireworks — shimmering starbursts, dazzling colors, and a chorus of “oohs” and “ahs” as the skies light up in celebration of independence. Yet, just as quickly as the thrill arrives, it fades. The finale fizzles, the smoke clears and the night eventually returns to its quiet calm.

What if there was a way to capture a different type of spark, one still fueled by self-determination, but one that’s built to endure? Financial independence offers exactly that — a kind of freedom that shines brighter than any firework display. It’s a path to security, a chance to pursue your dreams and the peace of mind that comes with knowing you’re in control of your financial future.

The good news? It’s achievable. With a few smart habits, some powerful tools and the right guidance, you can ignite your own financial independence. Let’s explore five habits to get you started on this journey.

5 Habits to Spark Your Financial Independence

1. Know your why.

Financial independence is not one-size-fits-all; it’s a personalized path to a life less burdened by financial worries. Whether it’s the freedom to travel the world, pursue a passion project or retire comfortably, financial independence allows you to align your future with your dreams. But how do you get there? The first step is building strong financial habits, and the very foundation of that journey is understanding your “why.”

Perhaps you want to:

- Reduce debt and breathe easier. Financial independence can help you pay down debt and eliminate the stress of monthly minimum payments, freeing you to focus on your goals with more confidence.

- Invest in a major life event. Whether it’s a dream wedding, that perfect house, a new car or a comfortable retirement, knowing you planned for it strategically brings a sense of accomplishment.

- Build a safety net. Life throws curveballs sometimes. Wouldn’t it be a relief to have a financial buffer in place to cover life’s surprises, like car repairs or medical bills?

- Free up extra cash for what matters to you. A little more wiggle room in your budget means more opportunities to spend money on things you value, such as a dream vacation, a fun fitness class, a cherished hobby or even a guilt-free night with friends.

Revisit this exercise as your life evolves because your financial goals will change along with you. Regularly reviewing your definition of financial freedom ensures your habits and strategies remain aligned with your long-term vision.

Also, share your goals with your banker. They’re there to listen, answer questions and help you build a plan that matches your “why”.

2. Embrace tracking and budgeting.

Financial independence requires taking control of your finances. Tracking and budgeting your money allows you to see exactly where it goes, from daily expenses to unused subscriptions. By allocating your money wisely, you ensure every dollar contributes to your financial goals.

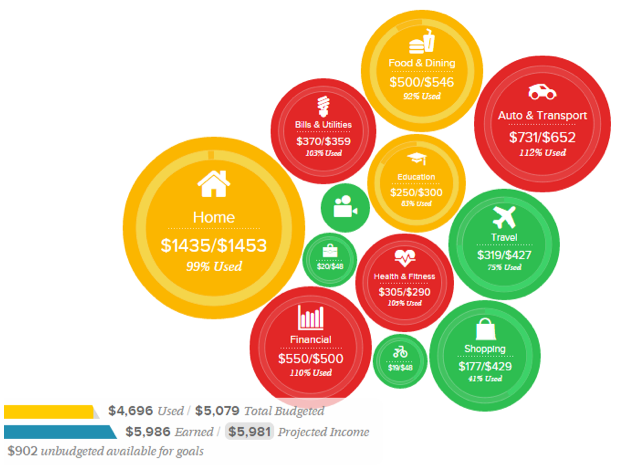

Personal financial management tools, like Bank of Utah’s My Money Hub, simplify this process, providing clear insights into your spending habits and helping you steer toward financial independence.

Here’s what that resource can do:

- Pull in all your accounts for a big-picture view. Connect all your accounts from all your financial institutions, including checking, savings, loans and retirement accounts, for a complete understanding of your finances.

- Categorize your transactions meaningfully. Say goodbye to mystery expenses. Advanced technology categorizes your spending, giving you a clear understanding of where your money goes. You can further refine these categories for more precision.

- Budget with ease. Create realistic budgets that align with your income and spending habits. Choose from auto-generated suggestions or create your own, and adjust them with ease.

- Stay motivated. Monitor your spending trends and prioritize goals with engaging visuals and progress reports, keeping you motivated on your financial journey.

Tracking and budgeting doesn’t have to be a chore. With personal financial management tools you can gain valuable insights into your spending habits, set achievable goals and take control of your financial future.

3. Automate your finances.

Managing finances can feel overwhelming, but what if you could simplify the process? Financial automation leverages technology to streamline your financial tasks, allowing you to focus on your goals while it handles:

- Punctual bill payments. Schedule automatic bill payments to ensure bills are always paid on time. This not only helps you avoid fees and reduce stress, it also keeps your credit score healthy for future big purchases.

- Effortless savings. Grow your financial future with automated transfers to your savings goals every payday.

The beauty of automation lies in its ability to free you from the burden of remembering due dates and transfers. You can still conveniently review transactions to ensure everything runs smoothly. Financial automation offers a win-win: less stress, more time and a brighter financial future.

4. Prioritize smart saving.

Expanding your savings portfolio with a variety of options can significantly accelerate your journey toward financial freedom. One effective strategy is to explore the range of savings vehicles offered by your bank, such as Certificates of Deposit (CDs) and savings accounts.

Here’s why CDs, in particular, are gaining renewed interest:

- CDs are a safe and reliable savings option with a fixed interest rate and maturity date. This guarantees your earnings and makes them ideal for specific goals.

- You can ladder CDs. This advanced saving technique involves splitting your savings into multiple CDs with varying maturity dates. As each CD matures, you can reinvest it at a potentially higher rate (if available), taking advantage of fluctuating rates. This also allows you to access a portion of your savings at regular intervals.

Using a mix of CDs and traditional savings accounts can enhance your overall financial strategy. CDs can be aligned with longer-term objectives, while savings accounts offer quicker access to funds and are ideal for short-term goals and emergencies. Diversifying your savings methods ensures that you have the right tool for each financial milestone.

If you’re new to CDs or want to brush up on the basics, this overview breaks it down simply. For more seasoned savers, this deeper dive offers ways to make your CD strategy work harder.

5. Invest for growth.

Turn investments into a grand finale of financial independence! Make investing a regular part of your financial routine, even if you start with small amounts. Review your investment strategy regularly and adjust as needed based on how much risk you’re comfortable with and your financial goals.

Artificial intelligence (AI) is becoming a powerful tool in finance and investing, helping people identify stocks, optimize portfolios and get tailored investment recommendations. For example, some use AI to build customized portfolios based on specific needs, like how much risk you’re willing to take. However, it’s important to approach this technology carefully.

While AI can offer significant advantages, it’s not perfect. The decisions made by AI can be complex and hard to understand, and relying too much on AI without fully knowing its limitations can lead to unexpected problems. Many financial institutions, like Bank of Utah, offer comprehensive investment management services to help you achieve your financial goals. They can manage investments for individuals and institutions, tailoring strategies to meet your specific needs. For personalized guidance, consider speaking with a banker who can connect you with wealth management experts.

As you navigate the evolving landscape of investing, remember to stay informed and cautious. Diversify your investments, understand the tools you’re using and seek professional advice to ensure your financial future is secure.

A Final Thought

Unlike fireworks, financial independence keeps its sparkle. Feeling inspired? Our bankers are here to chat, answer questions and help you build a plan that matches your dreams. Let’s make your financial freedom a lasting celebration. Visit your local branch or connect with a banker — they’re here for you!

This blog was written by a former Bank of Utah team member. For more financial insights, explore our blog collection. If you’d like to speak with someone directly, reach out to a local banking manager.