Some things in life you need, like housing, food and water. Some things in life you want, like movie nights, concert tickets and dinners out. Making the distinction between needs and wants seems simple, right? But sometimes it’s not so easy, especially when you feel like something could fit into both categories, like when you need to make a morning run to the coffeehouse or need to make a quick trip to the gas station for a fountain drink. You’ve just got to have that latte or that icy Coke! For me, it’s gummy bears. Some days I need those little jelly candies – want has absolutely nothing to do with it!

Whether you’re passionate about coffee, soda or other things that make your life more enjoyable – gummy bears! – the good news is you can fit those small wants into your budget, right along with your needs, and still have money left over to save, if you manage your spending wisely.

Knowing the Difference Between Needs and Wants

Needs are those things that are absolutely essential to live and work. They are often recurring expenses that eat up a large chunk of your paycheck. Some common needs are:

- Housing

- Transportation

- Insurance

- Food

- Utilities

Wants are those things that help you live more comfortably. They’re the things you buy for fun. You could live without them, but you enjoy your life more when you have them. Some common wants are:

- Travel

- Eating out

- Entertainment

- Designer clothing

It’s important to note that needs and wants aren’t the same for everyone. Take transportation, for example. If you live, work and shop close to a bus or train route, you might not need a car to get you to and from work every day, even if you dream about a sports car or pickup truck, like I do. But if you have a longer commute, you probably need a reliable vehicle to use through the week.

Take clothing, as another example. If you work inside all winter, you might not need more than one coat to walk from your car to your office, even if you’ve fallen in love with another one at the store, like my wife sometimes has. But if you work outside, you probably need a heavy, durable coat to keep you warm all day and another coat to wear just while out and about.

Budgeting for Both Needs and Wants

Ideally, your needs should only take 50% of your income. Once your needs are cared for, you can then plan how much you want to go toward saving and paying off debts. Once you’ve contributed to savings and paid down some of your debts, then you can think about budgeting for gummy bears — I mean wants!

Here are some quick tips to get you started:

- First, write down all of your expenses for the month, everything from rent or mortgage payments, to cell phone plans and water bills, to cable, food items, even right down to how much you spend on toilet paper.

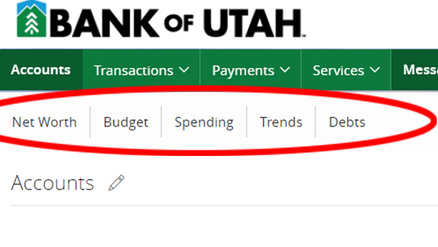

- Then, put each expense into a broader category, like housing, phone, utilities, groceries and toiletries. Bank of Utah customers can find easy-to-use tools within online banking to create a budget, monitor spending and identify trends, all fairly automatically.

- Finally, start separating the categories into needs and wants. Keep in mind: You need housing and utilities and probably even a basic phone plan these days. You might not need multiple streaming subscriptions or the biggest cable plan available. Categorizing items will help you start to see what falls into needs and wants.

Writing down all of your purchases has an added bonus: It makes you realize how much you’re spending on your daily coffee or, for me, gummy bears. For example, I can look at mine and say, “I spent how much on those jellied bears this month?!” Seeing all of your expenses in front of you may also help you recognize other areas where you’re overspending. Ask yourself, “Can I find a cheaper cable plan or do I really need Netflix, Hulu and Amazon Prime Video?”

Balancing Needs and Wants: It Will Pay Off in the End

Sometimes you have to make sacrifices now so that you can turn your wants into haves later. Yes, you may drive an older midsize sedan now or use a 3-year-old cell phone, but it’s important to remember that those things don’t define you. And, with thoughtful spending and saving, you can have a new vehicle (a big pickup truck or sports car — me again!) or the latest smartphone down the road, when it fits in your budget better.

This blog was written by a former Bank of Utah Banking Manager.