Tax season is in full swing, and that means funny tax memes are circulating on social media. I recently came across this one:

“I love to file my taxes,” said NO ONE EVER! (And it showed a man throwing his tax forms up into the air.)

I, for one, can’t recall having ever said those exact words or having heard anyone else say them, but I actually do appreciate tax season for this reason: It’s a great time to do a complete financial checkup. Because you’re gathering financial documents, your money is already on your mind, so why not check in and see how it’s working for you.

While it may sound like one more thing to do during an already busy time, it’s actually easy when you use My Money Hub, a personal finance management feature found within Online Banking and the Bank of Utah Mobile App. It brings all of your financial information together — not just from Bank of Utah but from your other financial institutions as well.

The seamless, safe integration of your accounts, plus My Money Hub’s five financial tools, give you a big-picture view of your finances. Plus, with bubble budgets and colorful, interactive charts, it’s a lot more enjoyable than taxes!

5 Ways to Use My Money Hub to Check on Your Finances

Just like it’s nice to have your tax documents organized in one place during tax season, it’s nice to have your assets and liabilities organized in one place, year-round. Having all of your accounts together, or “aggregated” as it’s also called, helps you make sure all of your money is working toward the same goal.

With My Money Hub, you can add your different checking, savings, loan and retirement accounts. (Your Bank of Utah accounts are automatically added for you. You can then add external accounts from the My Money Hub finance center database — you’ll just have to log in with those account credentials.)

To begin, link all of your accounts (look for the “Financial Tools” section in Online Banking and the Mobile App).

Then, you can then use the tools within My Money Hub to:

1. See your true net worth. Discover actionable steps to increase it.

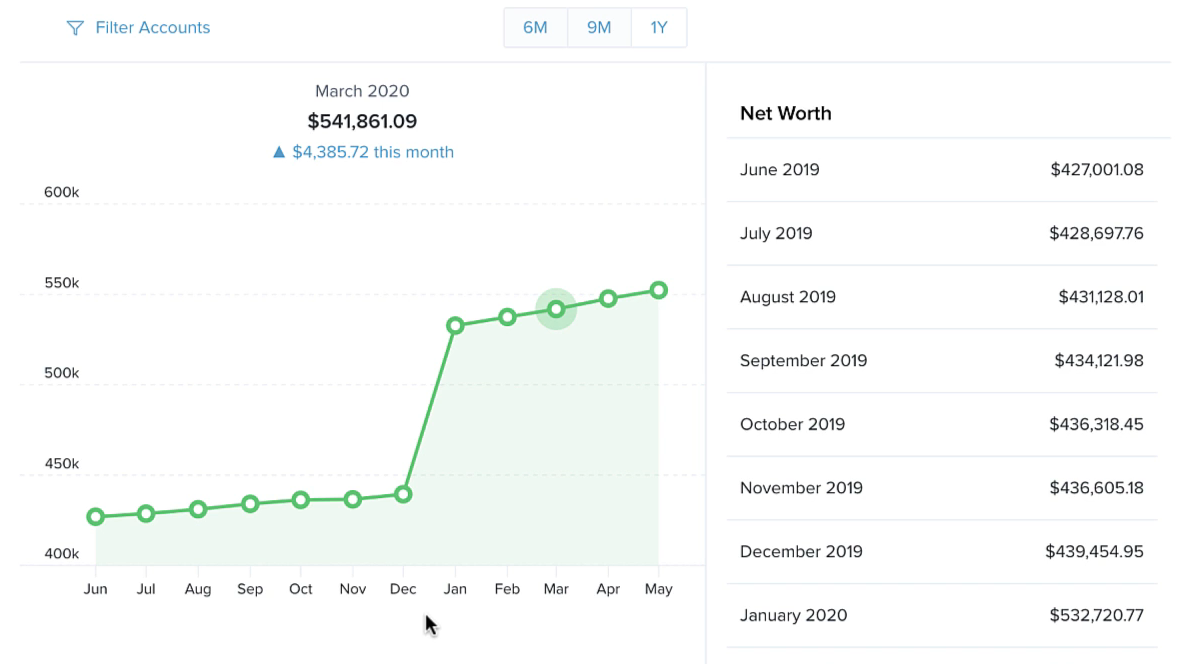

While tax season already has you thinking about your yearly income, it’s also a good time to think about your wealth in an even bigger way: through your net worth. Like your own personal balance sheet, net worth shows how your assets (what you own) and liabilities (what you owe) stack up in your overall financial health.

Increasing your net worth should be one of your financial goals. It’s important to track over time, so you know how well you’re balancing your spending and saving. That’s where My Money Hub’s net worth tool can help you. It includes your savings accounts, retirement accounts, property, investments and so on, and the chart it generates can give you a good idea as to whether or not you’re headed in the right direction: up!

You can even watch how the smallest change can impact your financial goals. Your net worth in My Money Hub will automatically update as your spend, earn more or pay off loans.

2. Create budgets. Set realistic goals and know how much you have to spend and save each month.

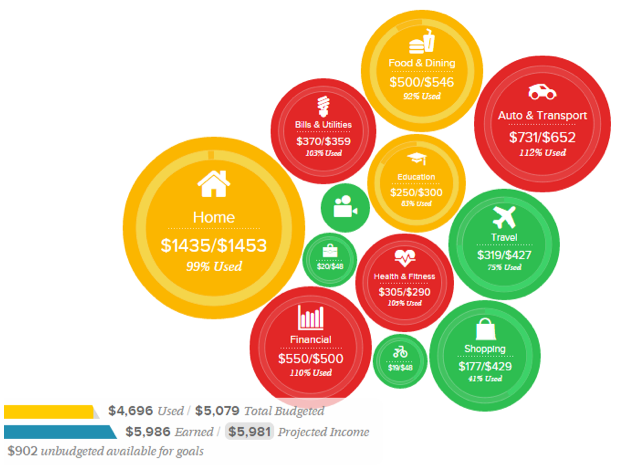

One way to keep your net worth trending upward is to use a budget. The less money you spend, the more your net worth increases. A properly maintained and regularly reviewed budget, with goals, can help you avoid overspending.

Using My Money Hub’s budget tool, you can pull from all of the accounts you’ve connected to get a colorful, picture of your budget status (red means over budget, green means under budget and yellow means near budget). The size of the bubble indicates the amount or value of that budget. It’s fun to interact with and easy to understand.

It’s important to note, however, that for the budgeting tool to work meaningfully, you have to make sure your transactions are categorized correctly. Your transactions get automatically categorized, but occasionally, you might need to edit it to be more accurate or specific. You can edit transaction categories by clicking on the transaction in Online Banking or the Mobile App, then clicking on the pencil icon next to “Category.”

You can create your own budget categories, too, to better suit your needs.

3. Keep tabs on your expenses. Stay in control of your spending.

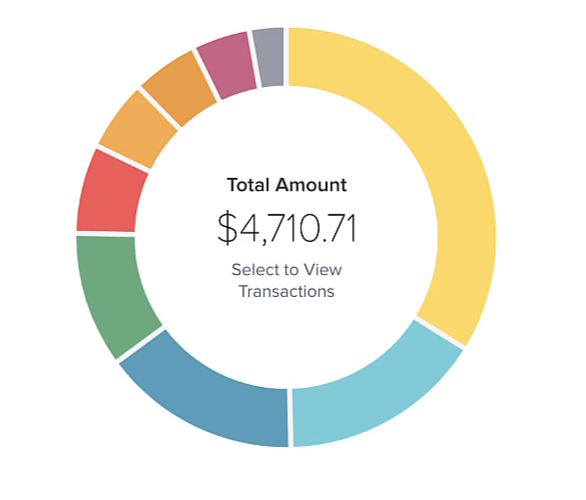

Once you’ve got your budgeting goals set and you know where your money should be going, now you need to know exactly where your money is going. This can help you identify areas where you might need to make some changes.

The My Money Hub spending tool can help. It highlights how much you’ve spent in total over the past 30 days, how much you’re spending in various categories and how much income you’re bringing in, all on a colorful wheel. You can even see a breakdown of spending by subcategory, such as how much of your spending in Food & Dining is on groceries versus eating out.

4. Track trends. Know where you’ve been and use it to make future financial decisions.

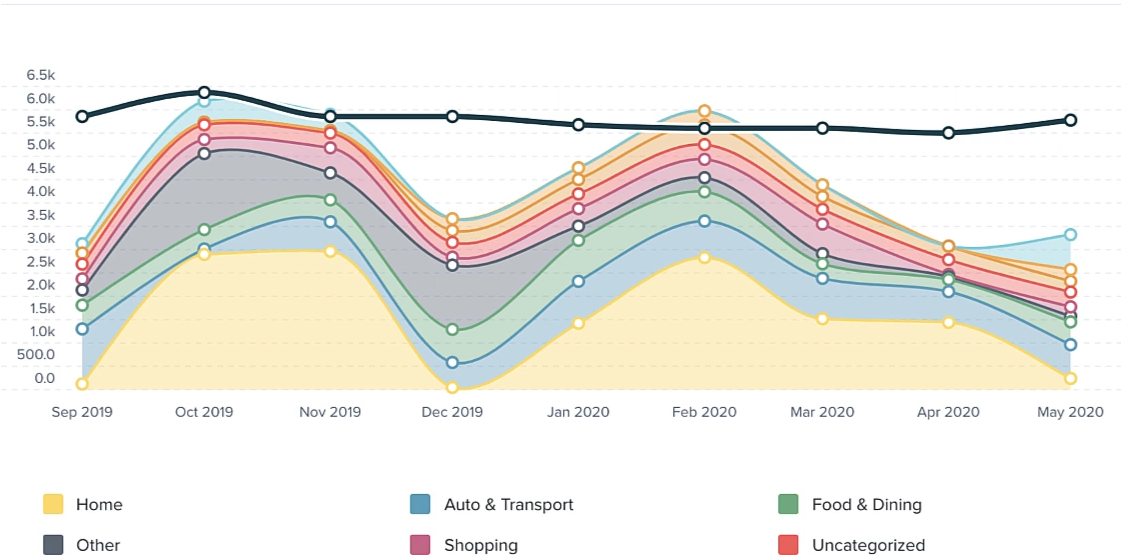

Trends are important because no two months are financially the same. Trends help you prepare for more expensive months (months with birthdays, anniversaries or holidays, for example) and also see where you may be able to save more to cover those extra expenses. Balancing those times out will work in your net worth’s favor.

Trends are important because no two months are financially the same. Trends help you prepare for more expensive months (months with birthdays, anniversaries or holidays, for example) and also see where you may be able to save more to cover those extra expenses. Balancing those times out will work in your net worth’s favor.

Using the trends tool, you can visualize up to 12 months of spending, by category, along with overall income. You might see that you’re actually spending a lot more than you thought in certain areas. Once you know that, you can course correct!

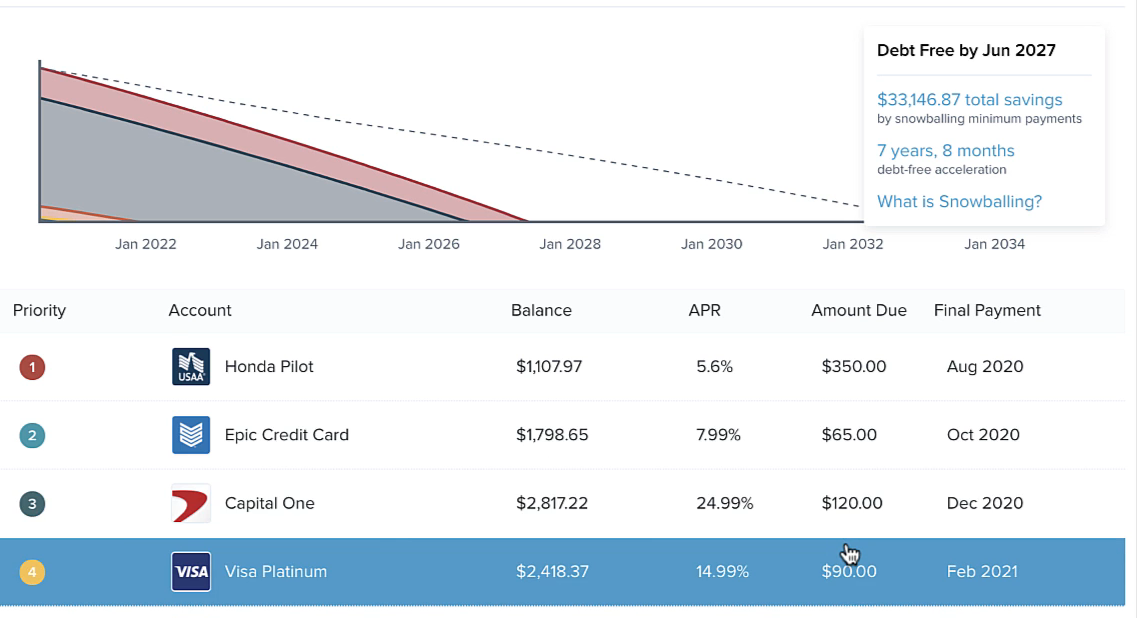

5. Prioritize debts. Pay them down faster by better visualizing them.

Now that you can visualize how these pieces work together (budget, spending and trends), you’ll want to decrease the liabilities in your net worth chart because as your debts go down, your net worth builds up.

Now that you can visualize how these pieces work together (budget, spending and trends), you’ll want to decrease the liabilities in your net worth chart because as your debts go down, your net worth builds up.

The debt tool pulls in your debt balances, annual percentage rates (APR), last payment date and minimum payments. It projects when you’ll make your final payment and allows you to adjust how debts are prioritized, so you can pay them off efficiently and build wealth faster!

Always Stay Focused on Your Money

While tax season is when your income and your money is really top of mind, don’t just check up on your finances at this time of year, check up on it monthly at least. Make it a priority because once you do, you’ll start to see your personal finances (and your net worth!) improve. And as you’ve already seen, My Money Hub makes it easy for you to get that clear picture of your financial life — digitally and all in one place.

If you need help organizing your finances or creating goals to spend and save smarter, reach out to our branches. We’d be happy to walk through it with you. After all:

“We love to help people set financial goals, manage their money and succeed,” said EVERY BANKER EVER!

Kimberly O’Neal is branch manager for Bank of Utah’s Bountiful and Roy branches. She has worked at the Bank since 2017. Kim enjoys volunteering with Junior Achievement of Utah.

Kimberly O’Neal is branch manager for Bank of Utah’s Bountiful and Roy branches. She has worked at the Bank since 2017. Kim enjoys volunteering with Junior Achievement of Utah.