Self-Directed IRAs offer unique investment opportunities for the savvy, do-it-yourself investor.

It’s March, which means the April 18, 2016 tax filing deadline is just around the corner. While in the process of filing our returns, most of us will be examining our household income, savings and retirement accounts. If you find yourself disappointed in the returns in your retirement accounts and you would like to take more control of your retirement investments, you might consider transferring available funds into a Self-Directed IRA.

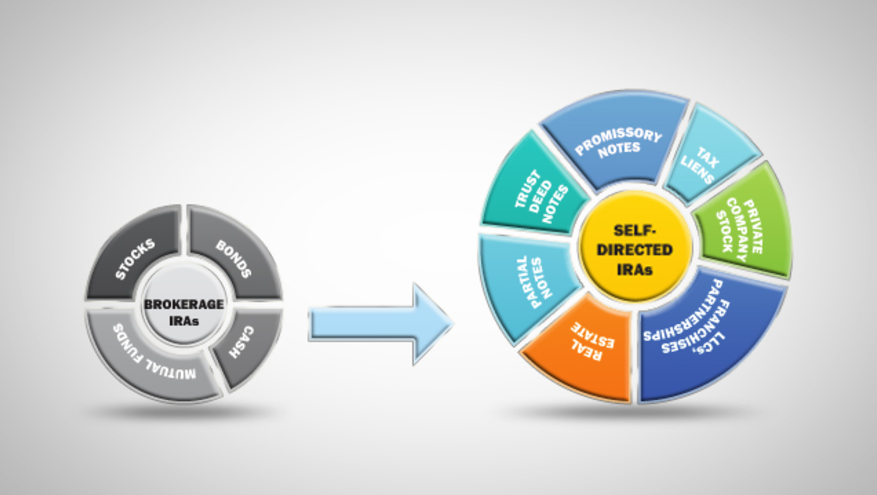

Many people use the Traditional IRA and Roth IRA accounts as their retirement savings vehicles. Typically the investments in those accounts are limited to stocks, bonds and mutual funds. A Self-Directed IRA allows you to take a more hands-on approach and invest using unique, non-traditional types of investments held by a bank trust department as a custodian. Some of those investments may include but are not limited to the following options:

• Real Estate (mortgages, land, land trusts, single family homes, apartment buildings)

• Promissory Notes

• Tax Liens

• Partial Notes

• Trust Deed Notes

• Private Company Stock

• LLCs, Franchises and Partnerships

How do I know if a Self-Directed IRA is right for me?

A Self-Directed IRA account isn’t for everyone, but if you have $100,000 or more in existing retirement accounts, and you have expertise in real estate or another area of business, you may want to transfer or roll your retirement funds over into a Self-Directed IRA or Self-Directed Roth IRA. Both are flexible tools that allow you to use your business acumen to choose your own investments and build your retirement wealth. The benefits to a Self-Directed IRA can include tax-free or tax-deferred growth, asset protection and estate planning benefits.

Self-Directed IRAs can be an ideal retirement plan option for small business owners. They can start building wealth for the future by establishing a self-directed IRA today, and they provide security for when it’s time to sell the business or turn over the keys to the next generation.

How do I get started?

First consult with your financial advisor and then call Bank of Utah Trust Department to help you set up your Self-Directed IRA account. Bank of Utah is one of the few institutions in the state that has both trust powers and the ability to hold custodial IRA’s. Our experienced trust administrators will help you throughout the year with your investment transactions. You can expect Bank of Utah to:

• Perform administrative duties

• Manage assets according to the direction of the owner

• File reports in compliance with IRA regulations

• Issue bank statements of net gains and losses

• Record all transactions pertaining to the IRA

With Self-Directed IRAs, you choose your investments and direct your trust custodian to make transactions on your behalf.

For a free downloadable brochure on self-directed IRAs click here.

David Guzy is Senior Vice President and Senior Trust Officer at Bank of Utah, with 25 years of industry experience. Click here to contact David Guzy.